Legislation update – Winter 2018

10th December 2018

In this update, we focus on issues that were topical throughout 2018. We look at a number of emerging laws and initiatives and what they mean for you.

UK Plastics Pact

The UK Plastics Pact, a collaborative initiative that will create a circular economy for plastics, was launched on 26 April 2018. It brings together businesses from across the entire plastics value chain with UK government departments and NGOs to tackle plastic waste.

SUEZ recycling and recovery UK was a founding signatory of this ambitious initiative with a goal to transform the UK plastic packaging sector by meeting four targets by 2025:

- 100% of plastic packaging to be reusable, recyclable or compostable

- 70% of plastic packaging to be effectively recycled or composted

- Take action to eliminate problematic or unnecessary single-use packaging items through redesign, innovation or alternative (reuse) delivery models

- Average recycled content across all plastic packaging to be 30%.

- 42 businesses, including major food and drink brands, manufacturers and retailers, right through to plastic reprocessors, have made their commitment to the Pact. The number is growing, with currently over 100 members including brands and supporting bodies helping to implement a number of small working group initiatives to deliver progress.

Brexit

The UK has already signaled that it will pass the revised waste directive into law once it leaves the EU. The revisions are linked to the Circular Economy Package and are planned to be approved before the UK leaves the EU.

SUEZ recycling and recovery UK is feeding into the options, appraisal work and helping to influence policy makers. We are focusing on contingency planning in respect to fluctuating exchange rates, RDF exports, freight costs and labour.

We have a working group in place reviewing the changing environment, and we are developing contingency plans for particular parts of the business, including looking at alternative end markets, off-takers and equipment suppliers.

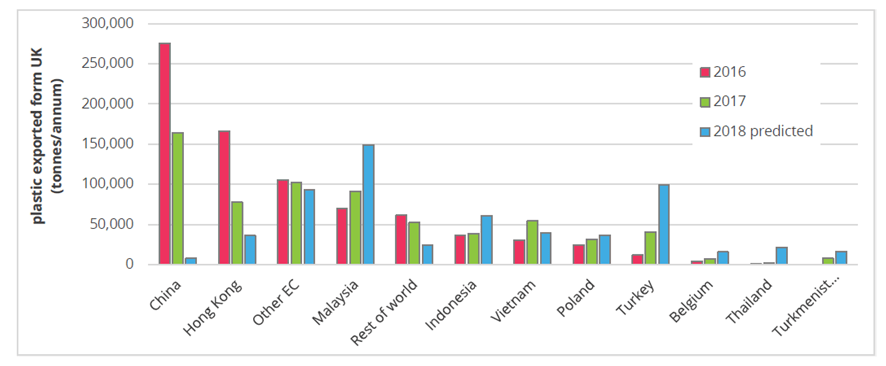

Chinese National Sword

China reduced the number of import shipments of waste plastic and unsorted paper in January 2018. The restrictions only allow for a contamination rate of 0.5% compared to the previous 5%, which is significantly more stringent than other end destination markets.

In anticipation of restrictions placed upon inbound recyclable materials by the Chinese Government, SUEZ recycling and recovery UK sought to secure alternative Asian and European offtake markets for its recyclable material products early in 2017. We have been successful in securing capacity in alternative markets and, as such, have not directly exported any material to China since April 2017.

The volume of materials sent to UK-based recovery facilities has increased, however their capacity hasn’t. SUEZ recycling and recovery UK is now measuring quality upon collection and disposal at the facility – if a load is deemed to have too much of contaminated material, the facilities are no longer accepting it.

Recovery facilities that are still accepting mixed recycling are charging more per tonne. Increased charges are caused by higher costs associated with sorting the materials to further reduce contamination, as well as lower prices paid by alternative end markets accepting collected materials.

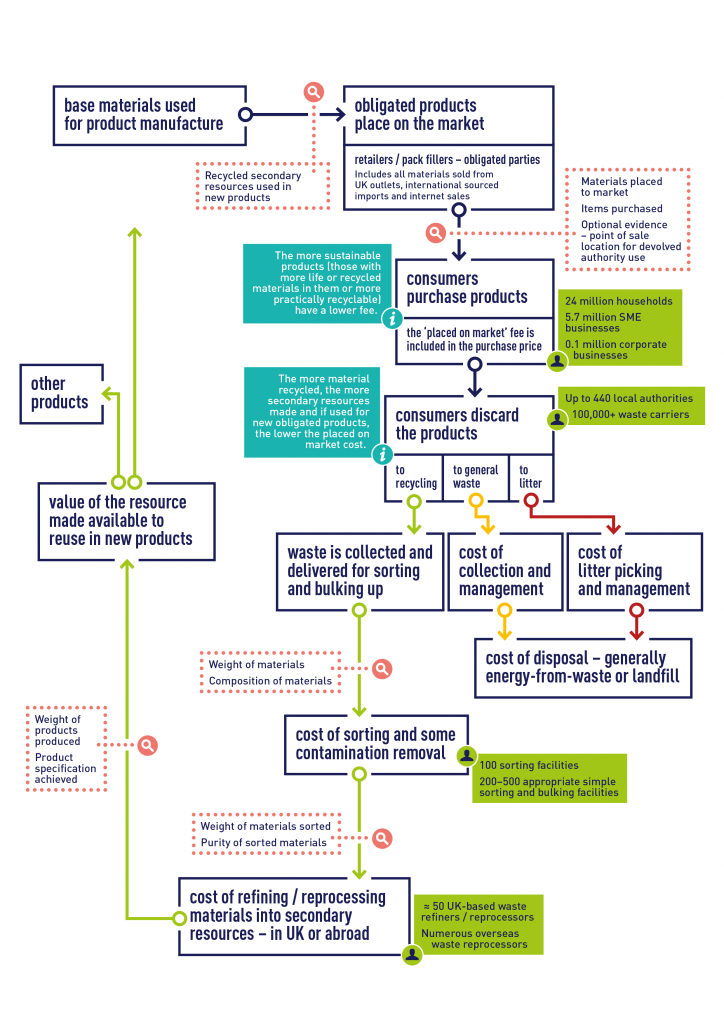

A ‘world-leading’ producer responsibility regime

In September 2018, SUEZ launched a document, entitled Unpackaging extended producer responsibility. The publication provides guidance as to how a fair and equitable producer responsibility regime could be most effectively implemented in the UK – based on the outcomes of workshops held with a wide range of stakeholders spanning the economic value chain.

In 2018, SUEZ conducted more than 25 workshops with various groups and organisations, seeking feedback on a range of policy interventions proposed by SUEZ in its manifesto for the future of resources and waste in England, which was published in May 2018.

Workshop attendees included representatives from the devolved administrations of Scotland and Wales, UK government, Coca-Cola, Iceland,

Marks & Spencer and INCPEN among many other brands, packaging manufacturers, consultants, local authorities, businesses and even consumers. The role of producers and major retailers was a particular focus of both SUEZ’s manifesto and the subsequent workshops.

At present, producers of packaging, batteries, vehicles and electrical items are obligated to demonstrate various recycling and recovery rates for the materials they place on the market. SUEZ believes that these obligations should be extended to a much wider range of goods, and that producers should contribute significantly more to the cost of collection, recycling and disposal – which in turn would spark a revolution in the way we view and treat waste in the UK.

In its guidance document, SUEZ presents 10 principles which it believes a

well-designed extended producer responsibility system should deliver. These include: more sustainable product design; enhanced brand equity for good performers; a fair and level playing field for all producers (including internet and global sellers); better informed consumers; a competitive marketplace; innovation in materials, products and recycling systems, and simplicity for all participants. SUEZ also believes it is important that the system should be delivered at minimal cost to the consumer, seek to deter fraud and crime, and reward or penalise businesses in a meaningful way based on their performance.

Five themes of DEFRA’s Resources and Waste Strategy

For the last 12 months, DEFRA has been working on its soon to be launched Resources and Waste Strategy. The Strategy is expected to deliver a significant step change in the way that wastes are managed, reflecting greater producer responsibility and driving the UK towards a more circular economy.

The Strategy will outline how England will meet the targets set out in previous government policy documents (including the Clean Growth Strategy, the Industrial Strategy, and DEFRA’s 25 Year Environment Plan) in particular:

- Double resource productivity by 2050

- Zero avoidable waste by 2050

- Zero avoidable plastic waste by the end of 2042.

In addition, the Resources and Waste Strategy must address how England will meet the requirements of the European Commission’s Circular Economy Package including:

- By 2030, all waste suitable for recycling or other recovery, in particular in municipal waste, shall not be accepted in a landfill

- Landfill ban for separately collected waste and limit municipal waste landfilled to only 10% by 2030

- Municipal waste recycling target of 55% by 2025, 60% by 2030 and 65% by 2035

- Food waste to be separately collected by 2024

- Promotion of prevention policies across the European Commission (EC) and within Member States

- Introduction of Extended Producer Responsibility systems with a minimum of 80% recovery of the costs incurred in managing the target waste streams to be paid by the ‘producers’.

Based on our numerous workshops, meetings and discussions with DEFRA officials we know that the Resources and Waste Strategy will need to address:

- How we will become a zero avoidable waste economy by 2050

- Phasing out avoidable plastic waste by 2042

- New targets for waste and recycling (in line with the EU’s Circular Economy Package)

- Stopping food waste going to landfill by 2030

- Reforming the Packaging Recovery Note (PRN) scheme.

We are expecting to see the Resources and Waste Strategy before Christmas 2018, accompanied by associated consultation documents seeking industry views on:

- Deposit return schemes (expected to be for on-the-go materials only or a wider definition of target containers, e.g. bottles and cans)

- Extended producer responsibility (the PRN reform) proposals concerning target materials, design of the scheme, whether taxes or deposits are paid by producers, and how the costs of effective recycling are covered off etc.

- Harmonisation (consistency) of collection systems, looking more closely at the materials being targeted, the containers and the communications etc.

Deposit return scheme continues to attract attention

SUEZ’s research into deposit return schemes (DRS) was launched at the end of March 2018. SUEZ commissioned consultancy, Oakdene Hollins, to undertake a global review of DRS systems and their impact on recycling rates, recycling quality and litter reduction.

Scottish consultation was responded to in October 2018, and we are awaiting feedback. Consultation in England is expected over Christmas. Our focus was on getting the right system that could work for ‘on the go materials’ (e.g. plastic drink bottles and cans).

New Environment Bill

SUEZ recycling and recovery UK fully supports a far reaching Environment Bill, one that any of us working in the resource sector could be proud of. As such, we believe the new Bill must go beyond what the European Commission (through existing Framework Directives and the Circular Economy Package) has signed up to and set clear environmental principles and outcomes that must be enshrined in British law, holding us all accountable for the next 25 years and beyond.

SUEZ firmly believes that well-designed and properly enforced environmental regulations can deliver positive economic outcomes in the form of increased business investment in innovation and skills, better quality products and infrastructure, greater business competitiveness and job creation – just as we have in recent decades, both in the UK and also globally. We are one of the 20 leading UK-based companies that signed a letter in the Telegraph calling for long-term goals to be preserved in the Environment Bill.

One current concern that SUEZ has, is that existing government policies remain misaligned and, in some places, in competition with one another. Currently, the Department for Transport (DfT) wants (and is incentivising) residual wastes to fuel both urban and aviation sectors, whilst DEFRA is looking to significantly reduce low grade plastic wastes. Add to this BEIS and its desire (again incentivised) for increased heat-offtake and future growth of both agriculture and chemical manufacturing sectors, and there is just too much demand for the non-recycled materials coming from the UK’s households and businesses.

Oversight is critical for ensuring that policies align and that the real priorities of global warming, resource productivity and economic development are achievable and delivered in a timely fashion.

SUEZ response to budget announcement

The budget contains a number of measures potentially affecting the resources and waste sector, including:

- A new tax on the production and import of plastic packaging from April 2022, applying to all plastic packaging that does not contain at least 30% recycled plastic.

- Reform of the Packaging Producer Responsibility System with the aim of incentivising the design of packaging that is easier to recycle and penalising the use of difficult to recycle packaging, such as black plastics.

- The Treasury does not intend to introduce a tax on disposable cups but will address this issue through the Waste and Resources Strategy.

- The Government will invest £20m to support plastics research and development, and to pioneer innovative approaches to boost recycling and reduce litter – and has committed £10m to clearing up abandoned waste sites.

- No incineration tax proposed, but the Treasury holds this in reserve if the necessary recycling performance is not achieved through alternative means.

Bioeconomy Strategy published

The Growing the Bioeconomy: Improving lives and strengthening our economy: A national bioeconomy strategy to 2030 for the UK was published on

05 December 2018. The Strategy is a joint effort of the government and industry and seeks to maximise the value of the bioeconomy in the UK – estimated to be worth £220 billion to the economy and contribute over five million jobs – and to respond to global challenges with bio-based solutions.

There are a number of opportunities identified in the document, including:

- Creating new forms of clean energy and new routes to high value industrial chemicals

- Producing smarter, cheaper materials such as bio-based plastics and composites for everyday items as part of a more circular, low-carbon economy

- Reducing plastic waste and pollution by developing a new generation of advanced and environmentally sustainable plastics, such as bio-based and biodegradable packaging and bags (whilst avoiding microplastic pollution).

The strategy also sets out a number of highly relevant actions:

- Government will explore developing a market intelligence tool to assess potential high value use of existing natural resources such as food waste, industrial by-products and other forms of biomass

- Support the Resources and Waste Strategy by potentially developing communications and tools that can help improve both the minimisation of waste and the maximisation of value from unavoidable waste, including collection services, recycling and labelling, and separation technology

- Help overcome barriers to introducing or growing new products/technologies, looking at areas such as: policy, regulation and industry guidance on waste; the impact of bio-based procurement and standards for bio-based plastics and other bio-materials; the demand, benefits and implications (for example the impact on recycling streams) of a standard for bio-based and biodegradable plastics.

- Bioeconomy strategy

- Brexit

- budget 2018

- Chinese National Sword

- Defra

- Environment bill

- Extended Producer Responsibility

- Legislation

- Plastic pact

- UK plastic pact